Mileage Logs

Whether you're a professional driver that routinely makes trips in your car or truck or just an office associate that occasionally drives for business purposes, mileage logs help ensure accurate reimbursements, letting you record every mile driven and vehicle-related expenses. For your other financial and bookkeeping needs, consider using columnar pads for tallying up calculations.

Track Vehicle Mileage and Expenses

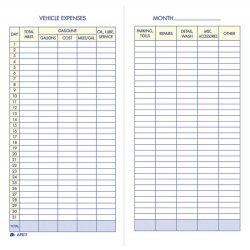

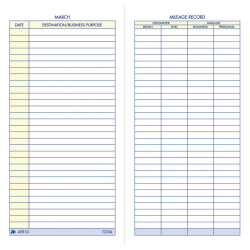

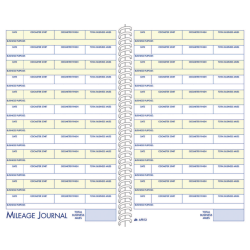

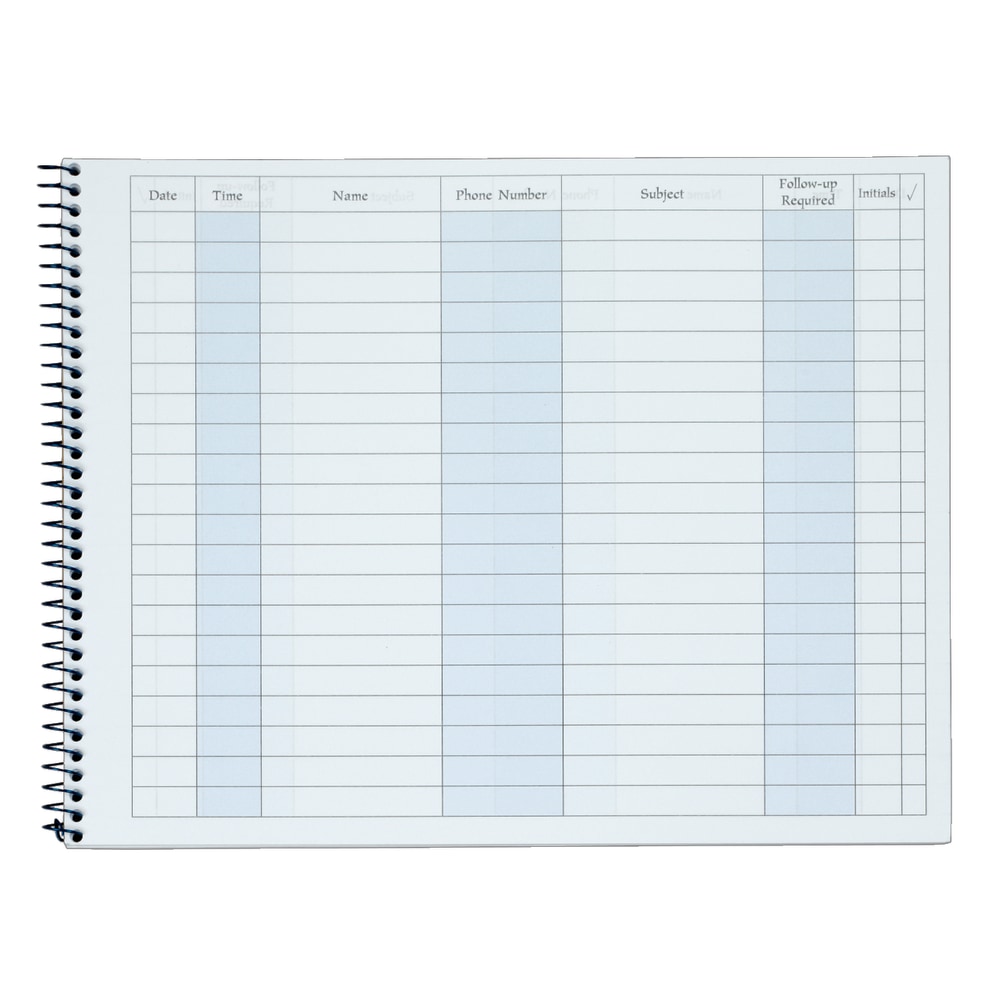

Using a vehicle mileage log, it's easy to keep track of your vehicle's mileage, calculating miles per gallon, as well as record expenses accumulated during trips, including oil changes and other maintenance, repairs, parking fees and tolls. Professional drivers can document time spent driving on the job and off the job, plus two-part forms allow a driver to keep a copy and submit a copy to a supervisor.

Book Construction

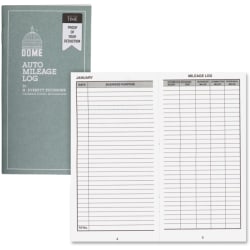

Look for an auto mileage log with built-in pockets, so you can conveniently stash receipts from service repairs, parking and tolls to substantiate claims. Detachable affidavits are perfect for tax preparation, and undated mileage logs can be used for an entire year for long-term documentation. Most mileage logs feature summary pages at the end, showing a driver's annual mileage and maintenance fees accrued. Due to the compact size of a vehicle mileage log, they can be easily stored and accessed in a glove compartment, plus durable vinyl or card stock covers keep information protected.

))

))